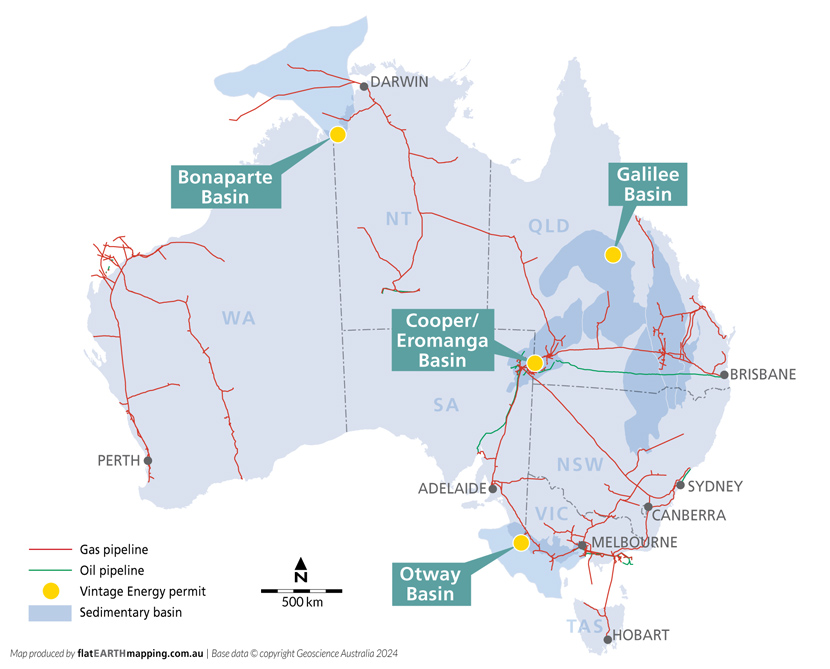

Vintage has a 50% interest and operatorship of two neighbouring licences in the southern flank of the Nappamerri Trough; ATP 2021 on the Queensland side of the Cooper/Eromanga basins, and the nearby permit PRL 211 in South Australia.

The licences are held in joint ventures with identical composition: Vintage Energy 50% interest holder and Operator, Bridgeport (Cooper Basin) Pty Ltd 25% interest and Metgasco Limited (25% interest).

Vintage, as Operator of the PRL 211 and ATP 2021 joint ventures, has drilled 5 wells all of which have been successful. The Vali-1 gas discovery in ATP 2021 was successfully appraised by Vali-2 and Vali-3.

Odin-1, drilled in PRL 211, discovered the Odin gas field. Odin-2 confirmed the field’s north eastern extent in ATP 2021.

Capital works conducted in 2022 and 2023 installed separation facilities at Vali and connected both fields to the Moomba gas gathering network.

Vali and Odin are undergoing long term production appraisal with a view to preparation of full field development plans.

Oil discovery potential has been identified and is being pursued in these licences, and the successful application licence PELA 679 which is subject to award.

PRL 249 50% interest

Vintage has 50% interest in PRL 249 in the South Australian onshore Otway Basin (50% held by Otway Energy Pty Ltd) which includes the Nangwarry gas field, a high quality (93% pure) carbon dioxide resource which Vintage discovered in 2020.

Nangwarry-1 possesses the quality and volume suitable for commercial production of food-grade CO2, a critical input for a wide range of manufacturing, storage, transportation, safety and healthcare applications. Vintage is engaging a wide range of stakeholders including users, suppliers, infrastructure providers and government on commercialisation options for the field.

In the Victorian onshore Otway Basin, Vintage has a 25% interest and Operatorship of PEP 171 with Somerton Energy Pty Ltd (wholly owned by Amplitude Energy Ltd), with the potential to earn up to 50%. This interest is to be divested in its entirety under a sales agreement announced 16 June 2025.

The Galilee Basin is a lightly explored gas province in proximity to market and the proposed Galilee-Moranbah pipeline.

Vintage holds a 30% participation in the joint venture with titles to the Deeps sandstone reservoir sequence (all strata commencing underneath the Permian coals (Betts Creek Beds or Aramac coals) with the main target being the Lake Galilee Sandstone sequence) in ATP 744, ATP 743 & ATP 1015 and their overlying Potential Commercial Area PCA”) PCA 319, PCA 320, PCA 321, PCA 322, PCA 323 and PCA 324 titles.

The Bonaparte Basin is a frontier basin in the north of the Northern Territory with a proven hydrocarbon system.

Vintage holds an interest in the onshore Bonaparte basin in EP 126, a low-cost entry which holds the untested Cullen-1 gas well, considered to possess excellent exploration potential.

Activity in EP126 is suspended pending resolution of discussion with the Northern Territory government in relation to declaration of approximately 50% of the permit, including the Cullen-1 well site as a ‘Reserved Area’.